by TheLorry on 3 August 2025.

Introduction

Owning a property has its perks. From the affluent suburbs of Subang Jaya and Bukit Tunku to the green hills in Semenyih and Banting, Malaysians are spoiled for choice when looking for a place to call home.

With new housing developments sprouting up each week and with each development sporting a fancier name with random numbers attached at the end, one wonders how developers find the time to think up new names.

It is easy for the first-time buyer to be sold by the glittering advertisements in the newspapers, on the internet and on the billboards. Thus, it is vital that potential buyers are equipped with the right information and knowledge which will enable them to filter out the white noise and come to an educated decision.

A decision made in the spur of the moment when purchasing a property could lead to many years of heartache down the road.

With the appearance of so many new developments, the prospective homeowner has to take into consideration many more factors when considering a property purchase.

In this article we will be analyzing a variety of factors such as location, financing, market and economic outlook, renovation and finally moving in.

In the sections below, we will be visiting each factor on a one-to-one basis and breaking it all down into only the most vital facts.

1.0) Financing

The kids need a place to run and play safely, the husband needs a den for all his hobbies, the missus wants it in the trendiest part of town but don’t forget, your in-laws want to stay over next weekend. But before you even consider the first step, you need to make sure you can actually afford a home. Before house‑hunting, the first WH-question is: can you actually afford it? Bank loans involve eligibility checks—age, income, credit score—and typical effective rates currently run between 4.15% and 5.67% per annum depending on your bank and loan package. When selecting a loan, don’t chase only the lowest headline rate; flexi-loans or zero-processing platforms may reduce long‑term costs.

Money, money, money. It makes the world go round, everyone wants it and no one ever has enough of it. Don’t worry, we at TheLorry understand the pains that everyone goes through, so before you do anything, sit back, relax and just follow these simple guidelines.

i) Bank Loans

Most likely, you’ve just gotten married, and maybe you have a kid or two. Thus, unless you are Mark Zuckerberg, Steve Jobs or Bill Gates or you have several hundred thousand ringgit sitting around, it is most likely that you will need to obtain financing from a bank or your good ol’ mak bapak also known to your older readers as MBF bank.

Realistically, the average home buyer will seek to obtain a loan from a bank when looking to purchase a home. Most banks will take into account several factors like your age, income, occupation and credit rating when deciding on your loan application.

Interest rates for housing loans offered by banks in Malaysia tend to range from 4.45% to 4.55%. Right now you might be tempted to go with the bank that offers the lowest interest rate. However, buyer beware as lower interest rates may also mean additional costs in the form of loan maintenance fees aka service fees (did you think it was that simple?)

Some banks offer a flexi-loan plan that allows home owners to personalize their loan repayments i.e. pay more when you have more, pay less when you have less. Other banks meanwhile may not charge the borrower with processing fees or monthly upkeep fees. So, don’t be shy and make sure you ask your loan officer as many questions as you can.

Walk into the branch of your chose bank, speak to the loan officer regarding a housing loan, and just fill out some forms. The bank will require you to provide documentation like your identification card and your three most recent pay slips.

After that, your loan application will be processed and your credit worthiness will be evaluated by the bank. Just make sure you do not have any outstanding loans that you may have “forgotten” to pay off.

Banks in Malaysia now peg retail housing loan rates to the Standardised Base Rate (SBR), which was lowered to 2.75% as of July 2025. Borrowers benefit from promotional effective rates—for example, Maybank’s Islamic HouzKEY starts at 2.88% p.a., while others like CIMB or RHB offer around 4.1%–4.9% depending on loan amount and bundle.

ii) Down payment

You just found the perfect apartment with the perfect location. You think you’ve finally found the place and you’re ready to apply for that loan from ABC Bank. But at RM450,000 you will need to provide a down payment of RM45,000 which is astronomical. That dear reader is known as the down payment.

For property purchases banks are willing to finance 90% of the value of the property. That means, you will have to make a payment of at least 10% of the property’s value.

How are you going to get that kind of money? You could of course again go back to you your mom and dad. Or you could go to another bank to obtain another loan to cover the down payment which would only result in you digging yourself deeper in debt.

Fortunately, the Employee’s Provident Fund or EPF is here to save the day. First and second time home buyers are allowed to withdraw funds from their Account 2 savings in order to finance the purchase of a residential property. First-time buyers can withdraw from EPF Account II to fund the down payment (or even to redeem loan balance), up to the lesser of 90% of savings or 10% of the property price.

iii) Fees, Fees, Fees and Then Some

Beyond your loan and down payment, be prepared for extra legal costs. For a RM550,000 property, legal fees under the Sale & Purchase Agreement could cost around RM4,300, while stamp duty could total RM10,500. This brings you to nearly RM15,000 in additional costs. Working with a reliable property lawyer is essential to ensure you don’t miss any steps or documents. But wait, there’s more! Aside from your down payment, it is advisable for the prospective homeowner to set aside additional funds to cover the following expenses:

Sales And Purchace Agreement Legal Fees

Professional Legal Fees:

| % | |

| First RM150,000 | 1 |

| Subsequent up to RM1 million | 0.70 |

| Subsequent up to RM3 million | 0.60 |

| Subsequent up to RM5 million | 0.50 |

| Subsequent up to RM7.5 million | 0.40 |

| Property Stamp Duty | % |

| First RM100,00 | 1 |

| Subsequent up to RM500,000 | 2 |

| Subsequent onwards | 3 |

Sourced from malaysianhousingloan.com

If all of that above confused you, fret not. We have prepared another set of tables which explains simply how both S&P fees and stamp duties are calculated using an example of a apartment valued at RM550,000

S&P Fees

| If the property price is RM550,000, the calculation is: | |

| First RM150,000 @ 1% | RM1,500 |

| Next RM400,000 @ 0.7% | RM2,800 |

| Total Legal fee | RM4,300 |

Stamp Duty

| If the property price is RM550,000, the calculation is: | |

| First RM100,000 @ 1% | RM1,000 |

| Next RM400,000 @ 2% | RM8,000 |

| Next RM50,000 @ 3% | RM1,500 |

| Total Legal Fee | RM10,500 |

Thus (a)+(b) = RM14,800. Which means, aside from paying RM55,000 for down payment, you should also be prepared to pay an additional RM14,800 in legal fees to your property lawyer and also your bank.

2.0) The Search

For most of us, buying a home is simply seen as the “next-step” in life. We buy a home just because we feel it is “time”. Yes, you’re married and you have a kid now with another one on the way, you feel pressured into making a decision, you feel it is the “next-step”. When considering where to live, ask yourself: are there good schools nearby? Is the traffic manageable? Is the area secure? Properties located in safe, accessible neighborhoods with quality schools tend to hold or increase their value, and they also make everyday life easier for your family.

Purchasing a home will most likely be the largest single purchase in your life, you will be putting yourself in serious debt which is no joke. However, fret not a residential property is also a serious investment which can net you some amazing returns if you make the right choice.

So, sit back, and take some tips

a) Location, Location, Location

Is the location ideal? Are there schools nearby? Are these schools any good? Will there be a garbage dump behind my home? Does the neighborhood have a crime problem?

Fairly simple, yes. But one would do well to conduct some background research before committing to a purchase. Walk around the neighborhood and get a feel for the neighborhood. Ask yourself, is this the kind of location that you would want your kids to grow up in? Would you feel safe letting them run around and play here?

A rule of thumb would be that safer neighborhoods located near reputable schools tend to maintain or even appreciate in value at a much higher rate as compared to neighborhoods with a serious crime rate.

Kindergartens or schools within a reasonable distance will help you cut down on child sitting costs and also transport costs. This will not only be easier on your wallet, but also your blood pressure. Imagine being late for work and having to rush your children to a school 20 minutes away all the while braving Monday morning rush hour traffic.

Never underestimate small details like the accessibility of your neighborhood. Remember, a development with limited entrances and exits often leads to congestion.

Yes, the surrounding area may be impressive and the price is amazing, but try telling yourself that when you’re running late but there is a traffic jam right at your doorstep.

b) Neighbors ( You’re not just buying the house, you’re buying a neighborhood)

Finally, you’ve found the perfect apartment in the perfect location. Everything seems to be going your way, but then just as you’re about to go to bed

Creepy neighbors, nosy aunties, midnight ravers and all round lunatics can make life in your new home a living nightmare. So, just before you commit to that apartment unit or the nice corner house, take a look around the neighborhood, ask a few neighbors and don’t be afraid to ring a few doorbells. You may be surprised what kind of information you can dig up.

Creepy neighbors aside, living in an area where everyone gets along well will make your house feel much more like a home. After all, no man or woman is an island.

Staying in a warm, close-knit community will do so much more to helping your children adapt to staying in a new, strange place.

c) Resale Value

Always keep in mind that a property is an investment, and ideally it should appreciate in value and provide you with a decent return on investment. Most first-time owners fail to consider the resale value of their homes 5 to 15 years down the road. If you are unlucky, you may have picked a home in a neighborhood with a high number of break- ins which in turn reduces your resale value down the road.

However, if you have done your homework and did your own research, you may find yourself pleasantly surprised by the returns that can be gained further down the road. Key examples are homes which have good accessibility, are within close proximity to reputable schools and are located in safe neighborhoods tend to appreciate at a much higher rate.

d) The Condition of Your Property

When viewing your first home, don’t forget to test everything in the house. The property agent or homeowner may think that you have lost your mind. But keep try telling yourself that as your home falls apart around you.

So, keep an eye out on the following:

1. Water Works

Do the taps work? How about the toilet? Does it flush properly? Is the water pressure from the shower weak? Remember, a shower just isn’t the same if it’s a trickle of water. When you turn on the taps, are there any signs of flooding or leaking from the pipes in the house. Does the water have a strange color or smell?

Discolored water could indicate rust in the pipes which may require an extensive overhaul of your entire plumbing system.

Scoping out all of these potential problems could save you thousands of ringgit from costly repairs at a later time unless you are a qualified plumber or contractor with plenty of spare time.

2. Is This Thing On?

The most expensive problems are usually the ones that you can’t see. Electrical work and wiring are one of those problems. You can test for these issues by simply flipping every switch in the house. Turn every light and appliance in the house on. Does everything work correctly? Or does turning on the fan result in your television blowing up.

Some homeowners may look to “potong jalan” by hiring sub-standard contractors and electricians to take care of the wiring in a house. Not only is this dangerous which may result in your house burning to the ground, it could also result in you having to fork out thousands to conduct a costly rewiring job.

So, ideally when scoping out a new property bring along a trusted electrician or contractor to give you a hand.

3. Was that supposed to fall out? (Fixtures and Fittings in the home)

Water damage or discolouration could indicate a leak in the roof. For example, wallpaper or paint that is flaking or falling off is a sure sign that the home you are in has issues with water leaking into the home.

Wooden fixtures and fittings that are disintegrating or rotting is another sign to look out for which could indicate a lack of maintenance by the previous owner.

4. Landscaping

Keep in mind that a lush beautiful garden requires that you put in time and effort into maintaining your garden. If you are not prepared for the commitment and difficulty, you may want to reconsider your decision. Trust us, those rose bushes won’t look so pretty when you’re drenched in sweat from gardening on a hot Sunday afternoon.

e) Hiring a Good Property Lawyer

Forget the stereotype that all lawyers are evil, a good property lawyer will help you cut through all of the required paperwork when purchasing a home.

Unless you have a degree in law and you are a master of all the various ins and outs of the legal process, we recommend enlisting the services of a property lawyer who will be able to guide you through the process.

3.0) Surveying Property Prices

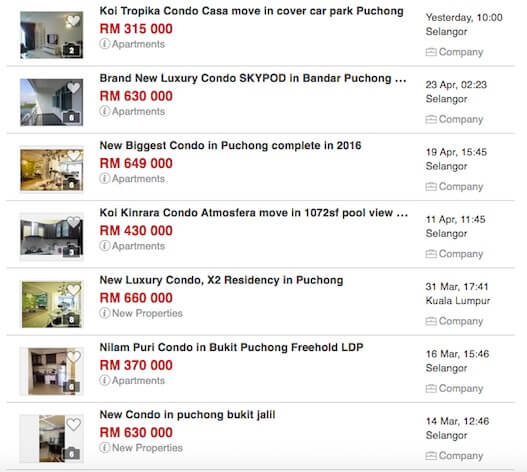

Before jumping into a decision, it is always wise to do a quick survey of the real estate market. With dozens of new developments sprouting up, you can always be sure that there are bargains to be found in the marketplace.

1. Advertisements and Classifieds

The easiest way to conduct some market research of your own is to flip through the classifieds. Some good examples are; Mudah.my, The Edge Property, iProperty, PropertyGuru and so many many more.

Such websites offer users the chance to survey property prices at their desired location. So instead of jumping in and making a choice, why not just have a quick look at the ads, these sites can be accessed by anyone with either a Smart phone or a computer and internet access.

If you are reading this article, you most likely will be able to start right now. Why wait?

2. Real Estate Agents

If you are not keen on doing your own research, you can always rely on a real estate agent or broker to do all the hard work for you. A quick Google search will reveal all of the real estate agencies within your area.

Real estate agents are usually knowledgeable and will be able to provide you with advice on the latest property prices in the market. Concentrate on building a close relationship with your agent, as they may be able to tip you off to the latest bargain in the hottest part of town.

However, buyer beware as real estate agents usually will have a percentage mark-up on their prices and may also charge you for their services. So, have some extra cash ready on hand should you choose to use the services of a real estate agent.

4.0) Closing The Deal

The end of the line. Finally, after months of searching you finally found the right house. All you need to do now is to approach the seller and make your offer. We can’t teach you how to negotiate, but a rule of thumb is to be polite and to the point.

After the seller has accepted your offer, follow these few steps;

- Apply for your bank loan at the bank of your choice. Bank will now appoint a independent property valuation agent who will determine the value of your property. Most banks are willing to provide 90% financing based on the property’s value, thus be prepared to fork out at least 10% of

your property’s value as determined by the bank. For example, an apartment valued at RM450,000 will require a down payment of at least RM45,000. - Sign the loan offer letter.

- Enlist the services of a property lawyer to guide you through the legal process, conduct the relevant title searches and draft out documents like the Offer of Purchase Form and the Loan Agreement

- Sign all the required documents.

- Break out the champagne, plan your housewarming and take delivery of the property.

5.0) Moving In

Congratulations! You are now the proud owner of a residential property.

You’ve gotten the keys to your new home and now all that’s left is to just move in. However, you haven’t the faintest idea of where to start. You could of course borrow your cousin’s van to move all of your furniture. But then, there is just way too much stuff, and his van looks like this:

* He says it’s a classic and he gets awesome milleagel.

So, what’s the next best thing? Like all Malaysian’s we whip out our phones and we contact TheLorry with the details of your job. Within an hour, they have arrived on site and are ready to pack up everything and get you moved into your new home.

This guide covers critical facets of a first property purchase guide Malaysia—from financing and EPF strategies to finding the right neighbourhood and managing moving tasks. If you’re ready to take the next step, let TheLorry help you move in seamlessly with our house moving package or on‑demand Lori sewa service. For disposal of old furniture or cross‑border relocation (Malaysia ↔ Singapore), we’ve got you covered as well. Have any questions? Contact our customer support on WhatsApp.

Start planning confidently—and let us make your move easy.

MY – EN

MY – EN Singapore

Singapore Indonesia

Indonesia